Bank Base Rates Definition

Bank’s Base Rates – for credit facilities in Euro entered into on or after 1 January 2008

Note: With effect from 15/03/2023, the Bank’s Base rates’ [(Bank Housing Base Rate (BHBR), Bank Base Rate (BBR), Bank Business Base Rate (BBBR)] calculation methodology includes the cost of wholesale funding.

The Bank has informed its affected clientele in December 2022. You can find the relevant document here."

- Bank Base Rate (BBR)

BBR is the Base rate of Bank of Cyprus and is calculated as the sum of (a) the weighted average of the average interest rate paid on euro-denominated household deposits in the Republic of Cyprus (outstanding amounts) by euro area residents with agreed maturities of up to 2 years as published on the website of the Central Bank of Cyprus on a monthly basis[1] (the ‘CBC benchmark rate’) and the Bank’s cost of wholesale funding and (b) a fixed spread of 2.24%. The BBR is revised on a quarterly basis (15 March, 15 June, 15 September & 15 December)[2] using the latest available CBC benchmark rate and the Bank’s cost of wholesale funding.

- Bank Business Base Rate (BBBR)

BBBR is the Business Base rate of the Bank of Cyprus and is calculated as the sum of (a) the weighted average of CBC benchmark rate[1]and the Bank’s cost of wholesale funding and (b) a fixed spread of 1.24%. The BBBR is revised on a quarterly basis (15 March, 15 June, 15 September & 15 December)[2] using the latest available CBC benchmark rate and the Bank’s cost of wholesale funding.

- Bank Housing Base Rate (ΒHBR)

BHBR is the Housing Base rate of the Bank of Cyprus and is calculated as the sum of (a) the weighted average of CBC benchmark rate [1] and the Bank’s cost of wholesale funding and (b) a fixed spread of 0.49%. The BHBR is revised on a quarterly basis (15 March, 15 June, 15 September & 15 December) )[2] using the latest available CBC benchmark rate and the Bank’s cost of wholesale funding.

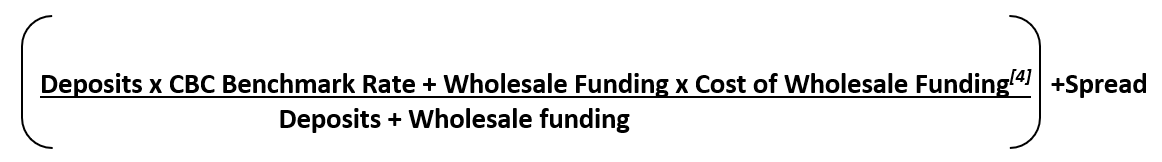

The Bank’s Base rates, including the BBR, BBBR, BHBR are calculated as follows:

Where:

Deposits:

Latest available amount of the Bank’s EUR fixed deposits and notice accounts outstanding as at the review date, as reported to the CBC

Wholesale Funding:

Notional of the Bank’s EUR outstanding[3] long-term unsecured debt to institutional investors as at the review date

CBC Benchmark Rate[1]:

Latest release of average interest rate paid on euro-denominated household deposits in the Republic of Cyprus (outstanding amounts) by euro area residents with agreed maturities of up to 2 years as published on the website of the Central Bank of Cyprus on a monthly basis

Cost of Wholesale Funding [4]:

Weighted average cost of outstanding long-term unsecured debt (weighted by notional outstanding as at the review date). For fixed rate unsecured debt, the cost would be the applicable yield at initiation. For floating rate unsecured debt, the cost would be the interest rate as at the review date

Spread:

For Bank’s Base Rate (BBR), the fixed spread is +2.24%

For Bank’s Business Base Rate (BBBR), the fixed spread is +1.24%

For Bank’s Housing Base Rate (BHBR), the fixed spread is +0.49%

Conditions and parameters which may contribute to changes in the methodology of calculating the Bank’s Base rates, including the BBR, BBBR, BHBR)

The Bank may at a future date:

- Amend the methodology so as to link each of the Bank’s Base rates to another benchmark rate. In case the benchmark rate changes, the respective spread over that benchmark rate may change accordingly.

- Amend the methodology of calculating any of the Bank’s Base rates if deemed appropriate due to potential changes in the regulatory framework, changes in market conditions or potential unavailability of the index used for the benchmark rate.

In the case of any change in the methodology of calculating any of the Bank’s Base rates, all affected customers / security providers / guarantors will be notified. Moreover, any change shall be effected in accordance with applicable legislation in force from time to time and the monetary and credit rules applicable each time.

For the purposes of this section:

[1]Published under Monetary and Financial Statistics (‘’MFI interest rates on euro-denominated deposits (outstanding amounts) by euro area residents”) at www.centralbank.cy.

[2] Or the next working day if not a business day.

[3] With initial term of over one year.

[4] It is understood that the Bank has the discretion to include at any time the cost of any new future wholesale funding in the calculation methodology of the Bank’s Base rates [(Bank Housing Base Rate (BHBR), Bank Base Rate (BBR), Bank Business Base Rate (BBBR)], if deemed appropriate.

The latest Bank’s Base rates are displayed here.

Bank of Cyprus’ Base Rate (BCBR) - for credit facilities in Euro

The Bank of Cyprus’ Base Rate (BCBR) is calculated as the weighted average of (a) CBC benchmark rate[1] and (b)the Bank’s cost of wholesale funding. The BCBR is revised on a quarterly basis (15 March, 15 June, 15 September & 15 December of each year (“Adjustment Dates”))[2] using the latest available CBC benchmark rate and the Bank’s cost of wholesale funding.

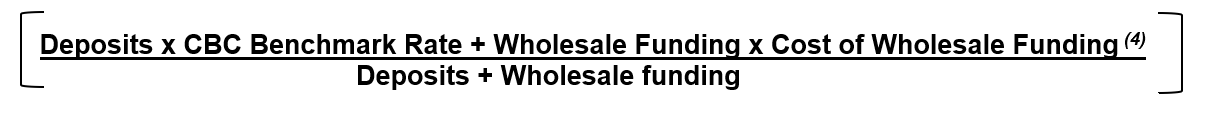

The Bank of Cyprus’ Base Rate (BCBR) is calculated as follows:

Where:

Deposits:

Latest available amount of the Bank’s EUR fixed deposits and notice accounts outstanding as at the review date, as reported to the CBC

Wholesale Funding:

Notional amount of the Bank’s EUR outstanding long-term[3] unsecured debt to institutional investors as at the review date

CBC Benchmark Rate[1]:

Latest release of the average interest rate paid on euro-denominated household deposits in the Republic of Cyprus (outstanding amounts) by euro area residents with agreed maturities of up to 2 years as published on the website of the Central Bank of Cyprus on a monthly basis

Cost of Wholesale Funding[4]:

Weighted average cost of outstanding long-term unsecured debt (weighted by notional outstanding as at the review date). For fixed rate unsecured debt, the cost would be the applicable yield at initiation. For floating rate unsecured debt, the cost would be the yield as at the review date.

If the relevant BCBR is less than zero, then BCBR shall be deemed to be zero for such interest period for the purposes of the credit facility.

Conditions and parameters which may contribute to changes in the methodology of calculating the Bank of Cyprus’ Base Rate (BCBR)

The Bank may at a future date:

- Amend the methodology so as to link the BCBR to another benchmark rate. In case the benchmark rate changes, an adjustment (spread) over the new benchmark rate may need to be applied, if deemed appropriate, to ensure that the move to the new benchmark rate is as close to economically neutral as possible.

- Amend the methodology of calculating the BCBR if deemed appropriate due to potential changes in the regulatory framework, changes in market conditions or potential unavailability of the index used for the benchmark rate.

Ιn the case of any change in the methodology of calculating the BCBR, all affected customers / security providers / guarantors will be notified. Moreover, any change shall be effected in accordance with applicable legislation in force from time to time and the monetary and credit rules applicable each time. The BCBR’s calculation methodology is also published on the Bank’s website at www.bankofcyprus.com under “Bank Base Rates Definition” section.

For the purposes of this section:

[1] Published under Monetary and Financial Statistics ("MFI interest rates on euro-denominated deposits (outstanding amounts) by euro area residents") at www.centralbank.cy.

[2] Or the next working day if not a business day.

[3] With initial term of over one year.

[4] It is understood that the Bank has the discretion to include at any time the cost of any new future wholesale funding in the calculation methodology of the Bank of Cyprus’ Base Rate (BCBR), if deemed appropriate.