Silver

Silver

Gold

Gold

Diamond

Diamond

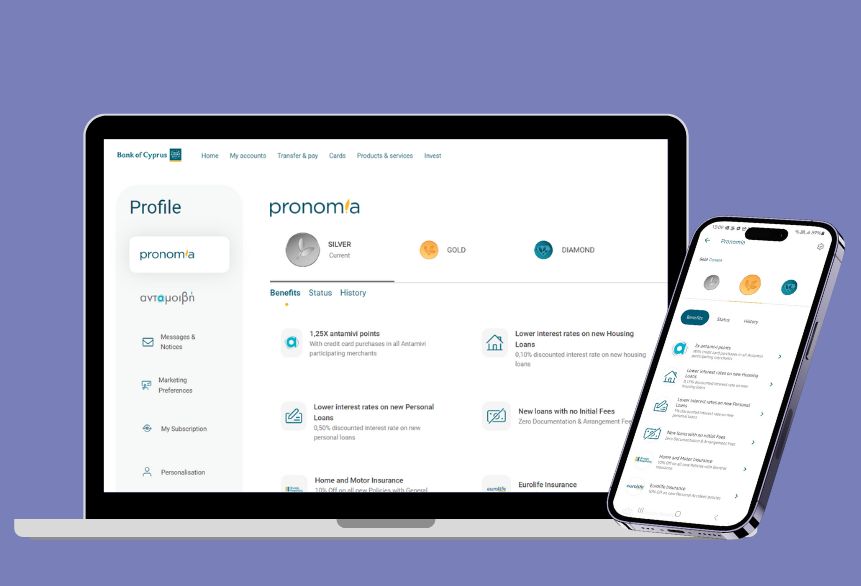

The pronomia scheme is our way of thanking you for your loyalty.

As your cooperation grows, your benefits increase. To participate, minimum requirements apply.

Join now for free through the BoC Mobile App or Internet Banking and start enjoying benefits such as:

for antamivi scheme

on new loans

on new loans

on new insurance policies

One additional product

One additional product

Loan other than housing

Loan other than housing

Current account with limit or Fleksy or Joey Sight

Current account with limit or Fleksy or Joey Sight

Eurolife insurance

Eurolife insurance

Genikes Insurance (home/motor)

Genikes Insurance (home/motor)

Credit card

Credit card

Option 1: Two additional products & deposits ≥ €50.000 or

Option 1: Two additional products & deposits ≥ €50.000 or

Option 2: Housing loan

Option 2: Housing loan

Loan other than housing

Loan other than housing

Current account with limit or Fleksy or Joey Sight

Current account with limit or Fleksy or Joey Sight

Eurolife insurance

Eurolife insurance

Genikes Insurance (home/motor)

Genikes Insurance (home/motor)

Credit card

Credit card

Option 1: Three additional products & deposits ≥ €100.000 or

Option 1: Three additional products & deposits ≥ €100.000 or

Option 2: Housing loan ≥ €200.000 & deposits ≥ €100.000

Option 2: Housing loan ≥ €200.000 & deposits ≥ €100.000

Loan other than housing

Loan other than housing

Current account with limit or Fleksy or Joey Sight

Current account with limit or Fleksy or Joey Sight

Eurolife insurance

Eurolife insurance

Genikes Insurance (home/motor)

Genikes Insurance (home/motor)

Credit card

Credit card

with credit card purchases in all "antamivi" participating merchants

available throughout the year

on new personal loans (also applies for QuickLoan)

on all new policies with Genikes Insurance

Silver

Silver

Gold

Gold

Diamond

Diamond

Find out your tier based on the existing cooperation you have with the Bank. If the following minimum requirements are met, you can join our reward scheme and start enjoying the benefits!

and find out…

You can join the Scheme at no cost but registration is not automatic. You have to follow a very straightforward procedure via BoC Mobile App or Internet Banking.

You need to meet certain minimum requirements, as well as additional criteria, to join. Customers who meet both, depending on their financial circumstances, will be assigned to one of the Scheme's three tiers (Silver, Gold, Diamond). The Scheme's website describes the minimum requirements and the additional criteria for each tier.

It is important to ensure that you have the latest version of the BoC Mobile app installed. Once you update the app, the option «join the pronomia scheme” will appear in the “what’s new” section. Alternatively, you can join the Scheme via Internet Banking. In case you still do not see the option, either in the BoC Mobile App or Internet Banking, you can call 800 00 800 for further investigation.

Once you register and give your consent to the processing of your personal data, we'll immediately notify you of your tier and the privileges you're eligible for.

Moving up or down the tiers:

The criteria for inclusion in the tiers of the Scheme are checked on a daily basis. In case you meet the criteria for a tier upgrade, this is done automatically the next working day. In addition, you'll get a push notification about the upgrade via the BoC Mobile App.

The same process applies when your ranking is downgraded - when you don't meet the criteria of your current tier. There's a grace period of three months prior to a downgrade, giving you the chance to take action to keep your tier. Also, one month prior to the downgrade you'll get a push notification via the BoC Mobile App.

Yes, you may, at any time, request to withdraw from the Scheme. The process is straightforward, and you can do it through BoC Mobile App or Internet Banking.

Extra reward points apply at all merchants participating in the antamivi scheme, provided that payments are made only with your credit card.

Reduced interest rates on new housing and new personal loans, as well as discounts on new insurance policies, apply depending on your tier on the opening of your loan/insurance policy. Reduced rates/discounts are not amended in the event of an upgrade or downgrade of your tier.

The reduced pricing you're entitle to, in case of a new loan is determined by your tier at the time of applying for the loan and not your tier after the loan is granted.

For example, if your tier is Silver and you apply for a new housing loan, you'll get reduced pricing on your housing loan based on the privileges of the Silver tier and not those of the Gold tier, which you will join after the opening of the housing loan.

Yes, the scheme has its own terms and conditions. Click here to view.

800.00.800

+35722128000 from abroad Monday to Friday, 07:45 - 18:00 Saturday and Sunday 9:00 - 17:00Find your nearest Branch

Or use one of our ATMs for your everyday transactionsA specialized officer

can get in touch with you to discuss everything you need to know about our productsWe currently do not offer any consumer finance service(s)/product(s), such as loans of any nature and/or investment services of any nature to persons in the United Kingdom. The information provided in relation to these service(s)/product(s) is neither directed at nor intended for persons in the United Kingdom and should not be acted upon by any such persons.