Financing the Net Zero Economy

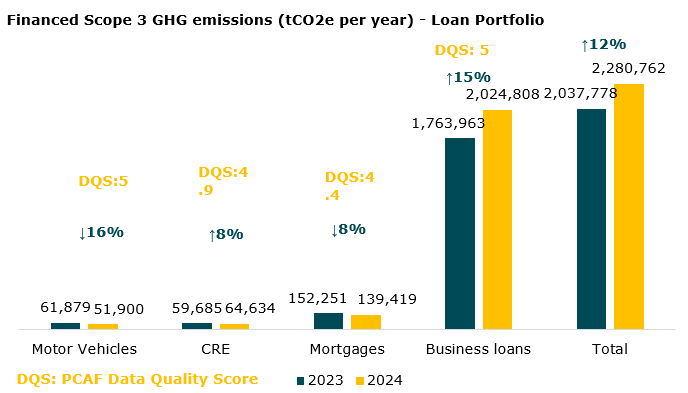

We are committed to the target set by the Paris agreement, the EU Green Deal and the Cyprus Government for a Net Zero goal by 2050. This entails reducing its Scope 3 emissions through the supply chain (i.e. third party providers) and its financing activities, which also entails the alignment and commitment of its clients towards this goal.

Decarbonisation targets

-

Mortgage portfolio

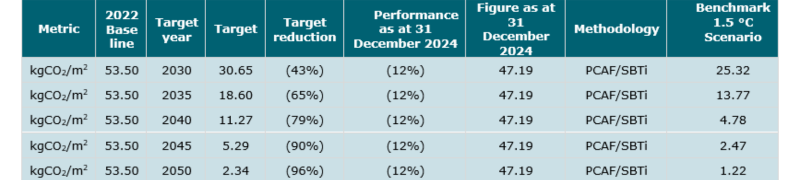

The Group, by taking into account the GHG emissions estimated for loan portfolio, the most significant loan exposures and the materiality assessment on climate related environmental risks, has set a decarbonisation target on Mortgage portfolio. The target is aligned with the Group’s ESG ambition to reach Net Zero by 2050. The Group has estimated the GHG emissions per square metre, as at 31 December 2022, for the properties financed under its Mortgage portfolio using the PCAF methodology and proxies, to identify the baseline. Then Group utilised the SBTi’s tools, sectoral decarbonisation approach, in order to estimate the decarbonisation pathway that the Mortgage portfolio should follow to be aligned with the IEA B2DS.

The Group aims to reduce by 43% the kilograms of GHG emissions financed per square metre (kgCO2e/m2) under the Mortgage portfolio, by 2030 compared to 2022 baseline. The Mortgage portfolio as at 31 December 2024 produced 47.19 kgCO2e/m2 which is 12% lower compared to the baseline due to increase in energy efficient residential properties financed in 2024 following introduction of Green Housing product.

-

Business Loan asset class

Given that the majority of Financed Scope 3 GHG emissions derive from Business Loan asset class, the carbon concentrated sectors under Business Loan asset class have been identified, based on PCAF definition, which are the primary sectors for setting decarbonisation targets. The primary sectors identified under Business Loan asset class are:

- Transportation and storage (51%),

- Wholesale and retail trade (19%),

- Manufacturing (11%) and

- Construction (6%).

Supporting customer sustainability journey

-

The Group has established an ESG Due Diligence process applied during credit granting and review process. The ESG Due Diligence process is applicable to customers that meet specific thresholds / criteria. During the credit application assessment process, that falls under specific thresholds / criteria, for granting new and/or reviewing existing credit facilities, Business Units must identify, evaluate and assess ESG matters that are relevant to the borrower. ESG Due Diligence includes the following:

- ESG questionnaires (applicable for new lending and review): The questionnaires must be completed by the customer, in order to collect relevant quantitative and qualitative information, identify and assess ESG matters that are relevant to the borrower and derive an ESG score which reflects the performance of the customer towards ESG factors and exposure of customers towards ESG risks.

- Scenario Analysis (applicable for new lending): The repayment ability of the borrower is evaluated under certain negative Environmental (E) scenarios, to assess the extent to which environmental risks affect the borrower’s financial position and repayment ability.

- Assessments under (1) and (2) above are evaluated and, where necessary, recommendations to borrowers in aligning with regulations and existing best practices are made, (depending on the ESG questionnaires results) and/or specific covenants will be set for monitoring (depending on the joint assessment of (1) and (2) above).

-

The Group’s Green Lending Policy, which is based on Green Loan Principles (GLP) of Loan Market Association (LMA), actively promotes financing towards projects with tangible environmental benefits, including projects aiming to mitigate climate change mitigation, adaptation and energy impacts and risks. In addition, the policy enables the Group to grasp green lending opportunities in the market. The policy establishes the criteria to classify a loan as ‘green’, focusing, among others, on projects such as renewable energy, energy efficiency, clean transportation, green technologies, climate change adaptation and Green buildings. By providing Green lending the Group effectively manages the material negative impacts and risks associated with energy, climate change mitigation and climate change adaptation. The Group is in the process of preparing the relevant guidelines, which will provide further guidance on the specific procedures to be followed for the complete operationalisation of the Green Lending Policy.

-

In BOC PCL, under our existing Environmental and Social Policy we prohibit finance to certain sectors (thermal coal mining, coal-fired electricity generation, upstream oil exploration, upstream oil development) which are included in our 'Exclusion and Referral Sectors' list with negative environmental impact.

-

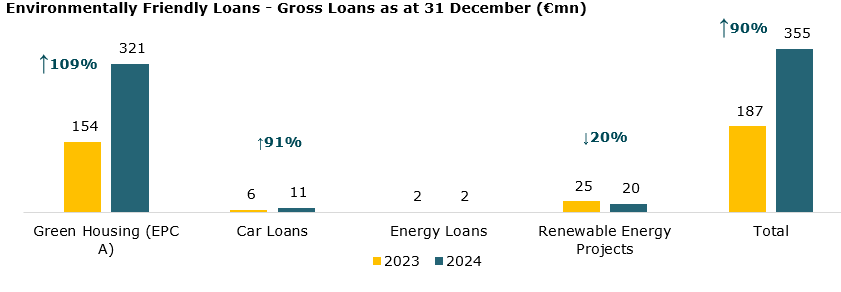

The Group offers a range of environmentally friendly products to manage transition risk and help its customers become more sustainable. For example, a number of loan products are offered under the Fil‑eco Product Scheme. The Group offers environmentally friendly Car Hire Purchase addressed to anyone who wants to buy a new hybrid or electric car, providing its customers the opportunity to buy a new electric or hybrid vehicle and to move away from transport options reliant on fossil fuels. Moreover, an environmentally friendly loan for home renovation is offered to customers who want to renovate and upgrade the energy efficiency of their privately owned primary residence or holiday home and achieve a higher energy efficiency rating. Further, the customers may benefit from an Energy Loan for the installation of energy saving systems for home use. This product is addressed to customers who seek financing for the installation of photovoltaic systems for home use and other home energy‑saving systems. At the end of 2023, the Group launched the Green Housing product, with variable interest rate and in 2024 launched Green Housing product with fixed interest rate, aligned with GLP of LMA, which drives the decarbonisation strategy of Mortgage portfolio. Green housing products provide a discount to customers providing the EPC Category A. The new lending strategy of the Group, embedded in the Financial Plan for 2025-2028, includes the ambition on the new Green Housing product in order be aligned with the GHG emissions reduction target set and manage transition risk.

-

The Group established a Sustainable Finance Framework (SFF) which is aligned with the GLPs of LMA. Under the framework an amount at least equivalent to the net proceeds of any Sustainable Financing Instrument issued by the Group will be allocated to finance new or re-finance, in whole or in part sustainable projects which meet the eligibility criteria of the Eligible Green (Renewable energy, energy efficiency, clean transportation, Green Buildings) and/or Social Project categories (Access to essential services – Healthcare and Employment generation and SME financing). The SFF enabled the issuance of its inaugural Green Senior Preferred Bond (Green Bond) in May 2024 for an amount of €300mn, in line with the Group’s Beyond Banking approach, aimed at creating a stronger, safer and future-focused bank and leading the transition of Cyprus to a sustainable future. The net proceeds of the Green Bond were 100% allocated based on eligible sustainable projects as of 31 January 2025. The Group published the Green Bond – Allocation & Impact Report in April 2025 associated with its inaugural Green Bond issuance.