1899-1979

-

The era of Ottoman rule has come to an end and the island passes into the hands of the British. Trade begins to pick up speed once again. The struggle to make a living is arduous and agonising. Heavy taxation, the ‘Cyprus Tribute’, diminishes all hope of economic and social development. The inhabitants of the island, the majority of which are farmers, have to contend not only with the land and the weather phenomena, but also with widespread usury that drains all funds. Their toil and sweat. Especially in times of drought. At the threshold of the 20th century, a group of Cypriot visionaries, spearheaded by Ioannis Economides, make a giant leap for the island by following through on their faith in the idea of savings and cooperation.

The era of Ottoman rule has come to an end and the island passes into the hands of the British. Trade begins to pick up speed once again. The struggle to make a living is arduous and agonising. Heavy taxation, the ‘Cyprus Tribute’, diminishes all hope of economic and social development. The inhabitants of the island, the majority of which are farmers, have to contend not only with the land and the weather phenomena, but also with widespread usury that drains all funds. Their toil and sweat. Especially in times of drought. At the threshold of the 20th century, a group of Cypriot visionaries, spearheaded by Ioannis Economides, make a giant leap for the island by following through on their faith in the idea of savings and cooperation.

New Year’s Day of 1899 marks the beginning of a new era! On this day, the ‘Nicosia Savings Bank’ is established. The Savings Bank’s first office operates in the Cyprus Association "every Sunday, Monday, Tuesday and Wednesday at 5-6 pm". The Savings Bank accumulates capital by receiving weekly payments. Depositors can purchase shares, with each share costing depositors one shilling per week for five years.

By May, depositors/shareholders are lining up outside the ‘Faneromeni’ coffee shop every Saturday between 6-7 pm to deposit their humble savings, collected through a thousand deprivations.

The first Assembly of the “Nicosia Savings Bank” took place in February 1900 and according to the Director of the Savings Bank, Ioannis Economides, "the amount recorded in the books until December 31, 1899 amounted to 3,004 pounds 10 shillings and 6 ¾ piasters. Shareholders of this Savings Bank amount to 362 with 998 shares. Each share of 57 shillings in 1899 yielded an interest of 2 shillings, but it must be said that the Savings Bank has operated for less than a year, moreover that the interest was yielded within six months since the payments are weekly."

The idea of savings gained more and more ground and slowly spread across the island, with savings banks being established in other towns and villages. Usury finally received its ‘punch in the gut’.

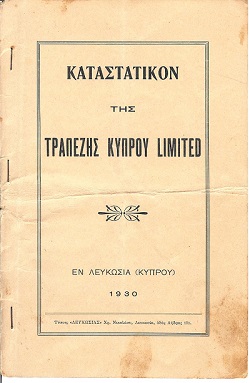

In February 1912, the shareholders signed a contract that marked the transformation of the ‘Savings Bank’ into a "societe anonyme under the name Bank of Cyprus for a period of 30 years and with a capital of 200,000 pounds divided into 50,000 shares worth 4 pounds each." A name that over the following decades would come to be associated with the entire island’s economy, society and history. The first General Assembly of the Bank of Cyprus is held in June 1913 at the Papadopoulou Theater. The following years are marked by success. In 1936, the Bank of Cyprus hired Eleni Kyrou, its first female employee.

World War II (1939-1940) cut the island off from foreign markets, sparking a severe financial crisis which saw 98,000 pounds worth of deposits flowing out of the Bank over a period of eight days. Despite the ban on the purchase and sale of foreign currency imposed by the colonial government, the Bank manages to cope with its own means, without resorting to borrowing. In 1940, all the deposits that had been withdrawn returned to the Bank's coffers. The first great crisis was over. -

In 1943, the Bank of Cyprus, with the slogan ‘Cyprus for the Cypriots’, is determined to support the Cypriot economy, and through a pioneering move succeeds in further strengthening its position in the local economy. It merges with banking institutions in other towns, radically changing the structure of the Cypriot banking system. It spreads all over the island, establishing itself as the Bank of all Cypriots. The ‘Koino Kyprion’ (common to all Cypriots) is now a reality.

In 1943, the Bank of Cyprus, with the slogan ‘Cyprus for the Cypriots’, is determined to support the Cypriot economy, and through a pioneering move succeeds in further strengthening its position in the local economy. It merges with banking institutions in other towns, radically changing the structure of the Cypriot banking system. It spreads all over the island, establishing itself as the Bank of all Cypriots. The ‘Koino Kyprion’ (common to all Cypriots) is now a reality.

As its official emblem, the Bank of Cyprus adopts the ancient Cyprus bronze coin – from the reign of Emperor Claudius (41-54 AD) – bearing the incription ‘Koino Kyprion’ encircled by a laurel wreath. A symbol of the union of all the inhabitants of the island, in an Assembly, with representatives from all Cypriot towns. During Roman times, the ‘Koinon Kyprion’ had great power and influence in the social and economic life of the island, as well as the right to issue all bronze coins. The bronze coin is now kept in the collection of the Museum on the History of Cypriot Coinage.

On May 25, 1944, the Mortgage Bank of Cyprus launches operations with a capital of 15,000 pounds, deposited entirely by the Bank of Cyprus, in view of meeting the needs for urban development.

Towards the end of the 1940s, the Bank of Cyprus, offering the largest number of business grants, provides financial assistance to the commercial world, while adopting a market stabilisation strategy, discouraging over-borrowing policies. Keeping a credit list, it sets discount rates for current accounts and foreign credit, for each customer separately.

At the same time, the Bank’s client base is growing and its expansion continues with new branches in Morphou and Kyrenia. In 1949, the Bank of Cyprus opens a privately-owned branch in Limassol. -

By the early 1950s, Bank of Cyprus was already celebrating half a century of operation. It is housed in privately-owned premises in Nicosia, Larnaca, Limassol, Morphou and Paphos. In the capital, it also buys the property next to the Main building in Faneromeni, in the heart of the city, in order to expand its spaces and cover its needs, housing the Cyprus Mortgage Bank and the Insurance Company. The new building will be "equipped with central heating which will provide favourable conditions for the staff during the cold winter months." This was unprecedented for the period.

The Bank has 140 employees in total: 74 in Nicosia, 21 in Famagusta, 18 in Larnaca, 17 in Limassol, five in Paphos, three in Morphou and two in Kyrenia.

At the General Meeting of shareholders in March 1951, President Demosthenes Severis announces a dividend of 10% and makes a fiery speech, referring to how it all started: “I look back with real pride but also with the deepest emotion at the time of the establishment of the Savings Bank, which was founded and maintained by the weekly shillings of mostly poor workers, whether they were men or women.”

In 1955, the Bank of Cyprus dared to take a big step beyond Cyprus by opening a branch in London, following the wave of Cypriot immigrants who left their country to seek their fortune in the colonial metropolis. By the end of the year, 420 accounts amounting to 80,000 thousand pounds had been opened.

The Bank of Cyprus made every possible effort to support its people. During the same period, it decided to help all needy students of secondary community schools pay their tuition.

During the summer months, it follows its people to the mountains – to Platres, Prodromos, Troodos – where it opens temporary branches in order to serve the select clientele of the island that is vacationing in the countryside. -

In 1960, John F. Kennedy is elected President of the United States, Yuri Gagarin feverishly prepares to travel to the moon, and the Republic of Cyprus takes its first steps as an independent state after the end of the ‘55 - ‘59 liberation struggle.

The Bank of Cyprus continues to invest in the future of the country. It encourages its employees to obtain university degrees and establishes the Finance Corporation to support entrepreneurship in meeting the needs of the world, providing funding for the purchase of machinery, cars and other items.

It launches the operation of Evlampios, the first computer, adopting modern trends in computerisation and data processing. Evlampios – who needs an entire room for himself - offers his services to other organisations such as Cyta, EAC, and Cyprus Airways, printing bills which until then were written by hand. The ‘70s find the Group in a state of reorganisation, with the establishment of the company Bank of Cyprus (Holdings), which takes over the shares of the Bank and all its subsidiaries, expanding its activities to other sectors besides strictly banking.

The ‘70s find the Group in a state of reorganisation, with the establishment of the company Bank of Cyprus (Holdings), which takes over the shares of the Bank and all its subsidiaries, expanding its activities to other sectors besides strictly banking.

Within the same decade, the Organisation enjoys the spotlight for every innovation in the financial sector, shifting the definition of the concept of service.

It creates the first Mobile Bank – a bus that travels across the villages of the island to serve the rural communities. It installs the first three ATMs in Nicosia, which bear the advertising slogan ‘Cash 24 hours a day’. At the same time, the first drive-through branch operates in Limassol, allowing the public to make their transactions without getting out of their car.

The Bank of Cyprus continues to support the public during the tragic events of 1974. It offers 50,000 pounds to the Relief Fund for the Victims of the Turkish Invasion. It proceeds with a full amortisation of debts and withdraws lawsuits that were initiated against its customers. It tries to support the economy by providing financing to companies. It adopts a refugee primary school in Paphos and offers equipment for the Children's Clubs to operate in refugee camps, while also distributing Christmas parcels and toys to children.

At the same time, it takes care of its personnel who were affected by the Turkish invasion, providing financial assistance to 32 employees. Although the Bank of Cyprus loses branches and cash to the occupied areas, it decides to refrain from declaring itself as affected and to be exempted from Law 54, in order to avoid even a temporary reduction in salaries. The lens through which the Bank of Cyprus sees, evaluates, and reacts to developments is one which focuses on its pillar. On the ‘Koino Kyprion’. Corporate Social Responsibility is deeply ingrained in its DNA and continues to evolve today, adapting to the needs to each era.