Our Investment Case

We continue to deliver on our strategic objectives of becoming a stronger, safer and a more focused institution capable of further supporting the recovery of the Cypriot economy and delivering appropriate shareholder returns in the medium term

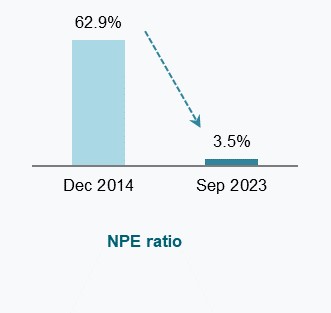

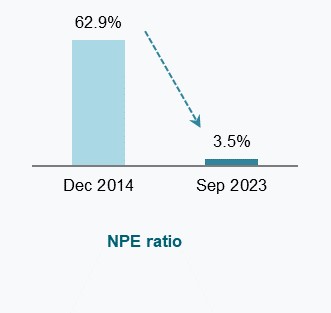

Reducing Risk

Systematic reduction of NPEs

Overall NPEs reduced by 98% since December 2014

NPE coverage at 77%

Strong Liquidity

Deposits at €19.3 bn at 30 September 2023

Liquidity surplus of €8.6 bn

Capital Position

Capital ratios are in excess of regulatory requirements

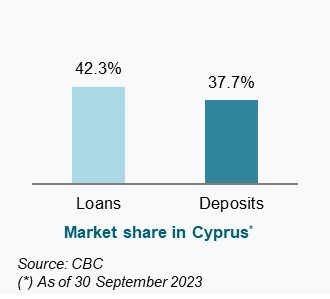

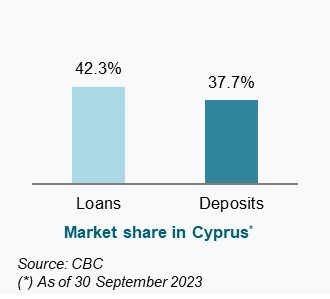

Strong Franchise

Strong market shares in Cyprus